What Is Required to Form Agency Relationship in Real Estate

As a Transaction Coordinator who thrives on the meticulous structure of real estate deals, few topics are as foundational—and frankly, as fascinating—as understanding agency relationships. Knowing precisely what is required to form an agency relationship is paramount for compliance, clarity, and smooth transactions. It’s the invisible thread connecting parties, woven through agreements and reinforced by duties. Let’s unspool this vital concept.

Forming the Real Estate Agency Bond

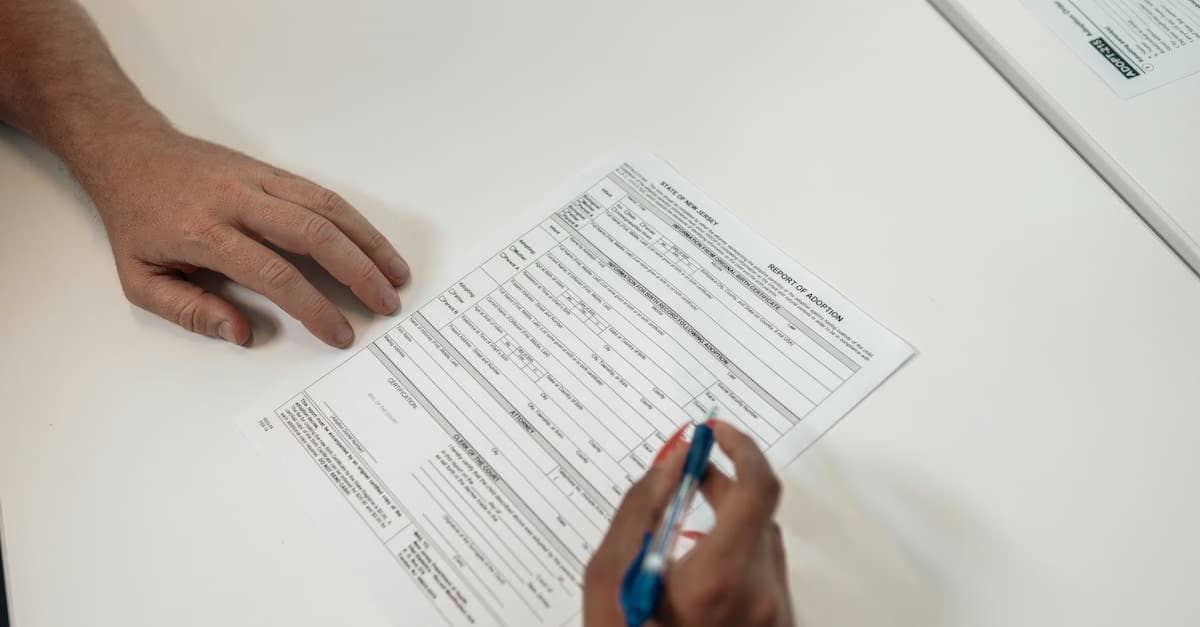

At its core, an agency relationship in real estate is a legal agreement where one party (the agent) acts on behalf of another party (the principal or client) in a real estate transaction. So, what is an agency relationship? It’s a relationship based on trust and mutual consent, usually established through a written contract.

While implied agency can sometimes arise from conduct, relying on it is risky business, legally speaking!

Legally speaking, what is required to form an agency relationship typically involves several key components:

- Mutual Consent: Both the principal (buyer, seller, landlord, or tenant) and the agent must agree to enter into the agency relationship. This isn’t a forced partnership; it’s a voluntary undertaking.

- Agreement (Often Written): While some states may recognize oral agreements, a written agreement (like a Listing Agreement or Buyer Representation Agreement) is the industry standard and best practice. This document clearly outlines the scope of the agent’s authority, the duration of the agreement, compensation, and the duties owed. File that under ‘absolutely essential documentation’!

- Authority: The principal must grant the agent authority to act on their behalf. This authority can be specific (e.g., listing a particular property at a specific price) or more general, as defined in the agreement.

- Fiduciary Duties: Upon formation, the agent automatically assumes specific legal obligations, known as fiduciary duties, to the principal.

Types of Agency & Who Owes Duties

Real estate operates primarily under different agency structures:

Single Agency

In a single agency relationship, an agent represents only one party (either the buyer or the seller) in a specific transaction. The agent owes their full fiduciary duties *exclusively* to that one client.

So, who owes fiduciary duties in a single agency relationship? The agent owes them to their principal. The agent does NOT owe fiduciary duties to the other party in the transaction (the customer), although they do owe them duties of honesty, fairness, and disclosure of material facts.

Dual Agency: Navigating Competing Interests

Now, let’s tackle the tricky terrain of dual agency. Define dual agency: Dual agency exists when a single real estate agent or brokerage represents both the buyer and the seller in the *same* transaction.

This creates a potential conflict of interest because the agent owes fiduciary duties to two parties whose interests are inherently opposed (one wants to buy low, the other wants to sell high).

Dual agent meaning: It means the agent is wearing two hats simultaneously in one deal. Because of the conflict of interest, dual agency is heavily regulated and, in some states, prohibited entirely. Where allowed, it requires strict adherence to disclosure rules.

Disclosed Dual Agency

This brings us to disclosed dual agency. This is the permitted form of dual agency where it is legal. For dual agency to be lawful, it MUST be disclosed to both the buyer and the seller, and both parties MUST give their informed, written consent.

A key document here is the dual agency disclosure form. This form explains the implications of dual agency and often outlines the modified or limited fiduciary duties the agent can perform for each party in this scenario (e.g., the agent usually cannot advise either party on negotiation strategy or the price to offer or accept).

Multiple mentions of disclosed dual agency and dual agency disclosure in regulations underscore their critical importance.

The Weight of Fiduciary Duties

Whether in single or dual agency, the cornerstone of the agent’s obligation lies in fiduciary duties of agents. These are non-negotiable legal and ethical responsibilities. The common law duties, often remembered by the acronym OLD CAR, are:

- Obedience: Following the lawful instructions of the client.

- Loyalty: Putting the client’s interests above all others, including the agent’s own.

- Disclosure: Revealing all known material facts and conflicts of interest to the client.

- Confidentiality: Protecting the client’s private information.

- Accounting: Properly handling and accounting for all funds and documents.

- Reasonable Care and Diligence: Exercising competence and expertise in representing the client.

These agency fiduciary duties are the ethical compass agents must follow.

Other Players and Classifications

What about other roles? Can an unlicensed assistant show property? Generally, no. Showing property, discussing property features beyond factual data, or engaging in any activity that requires interpretation or negotiation typically requires a real estate license. Unlicensed assistants handle administrative tasks, not activities requiring professional judgment or client interaction related to the core transaction elements.

Regarding compensation structures, an agent who agrees to work without compensation is called a ‘gratuitous agent’. Even without pay, the agent may still owe certain duties to the principal, though the scope might be limited compared to a compensated agent.

Finally, the term agent 1099 refers to the tax classification of most real estate agents. They are typically independent contractors, not employees, meaning their broker doesn’t withhold taxes, and they receive a 1099 form for income reporting. This classification doesn’t alter their agency relationship duties to clients but defines their relationship with their broker.

TC Tips for Navigating Agency

For us Transaction Coordinators, understanding agency isn’t just academic; it’s operational. Here are a few tips:

- Verify Agency Agreements: Ensure executed listing agreements or buyer representation agreements are in the file early. Check for dates, signatures, and clarity on representation.

- Flag Dual Agency: If the agent represents both sides, immediately look for the signed, dated dual agency disclosure form from ALL parties. This is non-negotiable paperwork!

- Check Disclosure Timing: In many states, agency disclosure is required early in the relationship, often at the first substantive contact. While agents are responsible for timing, TCs can help audit files for compliance.

- Understand Scope: Know who the agent represents to understand which disclosures are needed and which party’s instructions take precedence for that agent.

Why Agency Understanding Matters for TCs

Our role is to ensure compliance and facilitate a smooth transaction flow. Incorrect or missing agency documentation, especially regarding disclosed dual agency, can derail a closing or expose parties and the brokerage to legal risk. By verifying these elements, TCs act as a vital compliance checkpoint, protecting everyone involved.

Analysis & Insights

State laws governing agency relationships vary significantly. Best practice dictates erring on the side of maximum disclosure. The trend is towards greater transparency, particularly surrounding dual agency, reflecting the potential for conflicts. Ensuring that what is required to form an agency relationship is correctly documented and that all necessary disclosures, including the crucial dual agency disclosure, are handled properly is fundamental to professional real estate practice.

FAQs

Q: What is required to form an agency relationship formally?

A: Typically requires mutual consent between agent and client, and a written agreement outlining the scope of work and duties.

Q: What are the main fiduciary duties an agent owes a client?

A: Loyalty, obedience, disclosure, confidentiality, accounting, and reasonable care (OLD CAR).

Q: Can an agent represent both buyer and seller?

A: Yes, in states that allow dual agency, but only with the informed, written consent of both parties (disclosed dual agency).

Q: Is a gratuitous agent (one working without pay) still bound by duties?

A: Generally, yes, they still owe certain duties like honesty and reasonable care, although the full scope of fiduciary duties might be modified by state law.

Resources

To dive deeper into these concepts, check out these resources:

- Rebillion.ai – Explore how technology can streamline your TC process, keeping those essential documents in order.

- Rebillion’s Real Estate Blog – More insights into real estate best practices and industry topics.

- Rebillion TC Automation Tools – See how automation can help you manage the complexities of agency documentation efficiently.

Conclusion

Understanding what is required to form an agency relationship is non-negotiable in real estate. From the foundational agreement to the nuances of single vs. disclosed dual agency and the unwavering commitment to fiduciary duties, each element plays a critical role. For Transaction Coordinators, mastering these concepts and verifying the associated paperwork is key to ensuring compliant, ethical, and successful transactions. Let ReBillion.ai help you keep those files tidy and agency relationships crystal clear, ensuring every transaction flows seamlessly.

This article is for informational purposes only and does not constitute legal or compliance advice. Always consult a qualified professional or brokerage attorney for guidance tailored to your jurisdiction and business model.

ReBillion.ai helps real estate brokers, agents, and transaction coordinators streamline operations with AI-powered automation, transaction coordination, and virtual assistants. Whether you’re closing more deals, managing hundreds of contracts, or growing your team, ReBillion.ai simplifies compliance, workflow, and growth. Visit ReBillion.ai to explore solutions or request a demo.