Mastering the Real Estate Market Shift for Agents Amidst Rising Rates

The real estate market shift for agents driven by high interest rates presents significant operational hurdles, particularly in maintaining compliance and streamlining transaction coordination amidst increased complexity. As a former US Realtor, I’ve seen market fluctuations, but the current environment demands acute operational efficiency and strategic adaptation. Brokers face the challenge of supporting their agents through longer deal cycles, more complex negotiations, and a greater need for diligent file management. Adapting to this market requires leveraging technology and rethinking traditional workflows to stay competitive and profitable.

Understanding the Impact of High Interest Rates on Agent Workflow

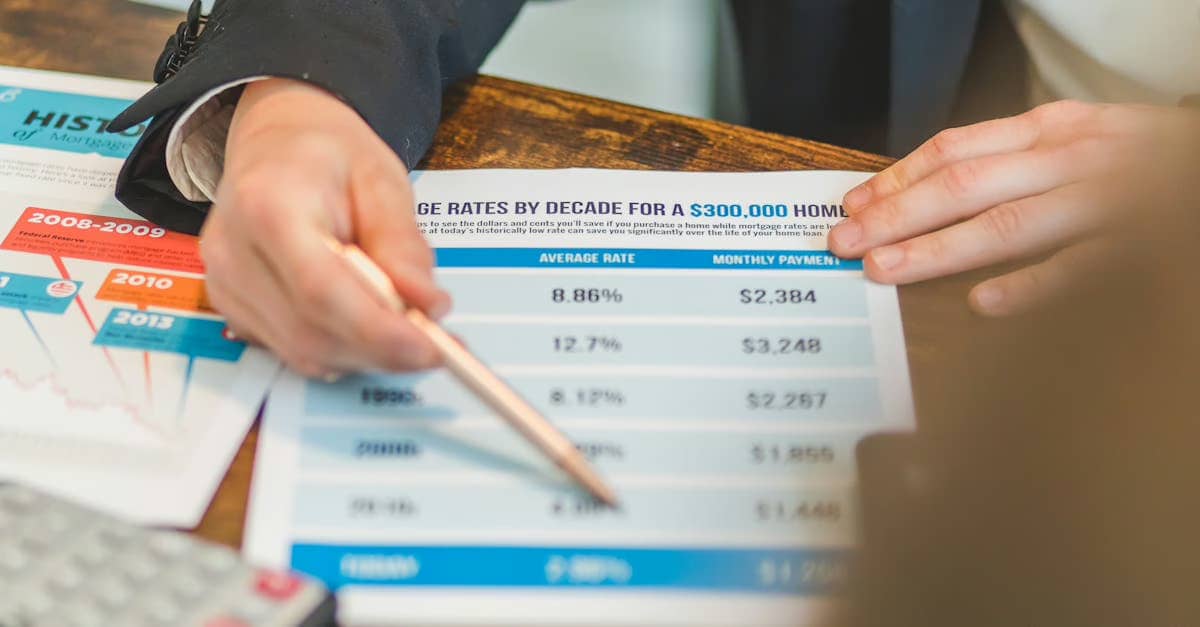

Higher interest rates directly impact buyer affordability, leading to fewer qualified leads, tougher negotiations, and increased transaction fallout. For agents, this means spending more time per client, showing more properties, and navigating intricate financing contingencies. The administrative burden escalates significantly. Each potential deal requires meticulous follow-up, detailed documentation, and robust compliance checks, demanding tools like advanced transaction coordinator tools to manage the pipeline effectively.

Client Management and Nurturing in a Slower Market

In a rapid market, leads might close quickly. In a slower, high-rate market, client nurturing becomes paramount. Agents need systems to stay in touch with prospects over extended periods. This isn’t just about sending emails; it’s about providing value, market insights, and maintaining a personal connection. Brokerages must equip their agents with sophisticated CRM capabilities, often part of comprehensive real estate automation platforms. A smart back office system that integrates CRM with transaction management helps ensure no lead falls through the cracks and all interactions are tracked for compliance.

Re-evaluating Lead Generation Strategies

Traditional lead generation methods might yield lower returns. Agents need to pivot to strategies focused on motivated sellers (job transfers, life events) and buyers who are less interest-rate sensitive or understand creative financing options. Brokerages can support this by providing targeted marketing materials and training. Implementing real estate automation for lead segmentation and targeted outreach allows agents to focus their efforts on the most promising prospects.

Operational Challenges and the Need for Enhanced Brokerage Efficiency

The real estate market shift for agents due to high rates stresses brokerage operations. Margins can tighten as deals take longer. Ensuring every transaction is compliant becomes even more critical to avoid costly errors or audits. This is where brokerage efficiency tools become indispensable. Manual processes, prone to human error, are no longer sustainable in this environment. Automated compliance checks and standardized workflows are essential.

Streamlining Transaction Coordination in Complex Deals

High rates often lead to more complex deals involving seller concessions, buy-downs, or unconventional financing. Each complexity adds layers to the transaction process, requiring more communication, documentation, and deadline tracking. AI transaction coordinators offer a powerful solution. They can automate routine tasks like document collection, reminder emails, and status updates, freeing up human transaction coordinators and agents to focus on the nuanced aspects of complex negotiations and client communication. This level of support is crucial for maintaining real estate broker compliance.

Leveraging AI and Virtual Assistants for Support

The increased workload per agent translates into a need for scalable administrative support. Hiring full-time administrative staff for every agent might not be financially feasible in a fluctuating market. This is where virtual assistants for real estate shine. VAs can handle tasks such as scheduling showings, managing MLS listings, social media posting, and initial client qualification. When combined with AI transaction coordinators, brokerages can create a powerful, flexible back-office infrastructure that adapts to deal flow without significant fixed overhead. ReBillion.ai offers AI Virtual Assistants for Real Estate Brokerages that can significantly boost productivity.

Compliance Management in a Changing Regulatory Landscape

Market shifts often coincide with, or necessitate, changes in regulations. Staying on top of disclosure requirements, financing laws, and ethical practices is challenging even in stable times. In a volatile market with complex deals, the risk of compliance breaches increases. Robust real estate broker compliance systems are non-negotiable. These systems should provide checklists, audit trails, and automated flags for potential issues. Tools like those offered by ReBillion.ai can monitor agent activities against compliance standards, providing peace of mind and protecting the brokerage from liability. Ensuring agents use approved marketing materials and adhere to fair housing laws is easier with centralized compliance monitoring.

Implementing Smart Workflows and Automation

Mapping out and automating workflows for listing agreements, buyer representation agreements, offers, and closing processes is fundamental to achieving efficiency and compliance. Automation ensures that every step is followed, every required document is collected, and every deadline is met. This reduces the cognitive load on agents and administrators and significantly lowers the risk of missing critical items that could lead to compliance issues. A smart back office system uses automation to drive predictability and consistency across all operations. Explore smart back office solutions at ReBillion.ai.

The Role of Centralized Data and Communication

Disjointed systems lead to errors and inefficiencies. A centralized platform that integrates CRM, transaction management, compliance tracking, and communication tools is essential. Agents, TCs, brokers, and clients should be able to access relevant information in one place. This transparency improves communication, reduces back-and-forth, and ensures everyone is working with the most current data, critical during the real estate market shift for agents.

Actionable Tips for Brokers Navigating the Shift

Here are 3–5 immediate steps brokers can take to navigate the real estate market shift for agents driven by high interest rates:

- Assess Current Technology Stack: Evaluate if your current tools support efficient transaction management, compliance tracking, and client nurturing in a slower market. Look for integrated platforms like ReBillion.ai that offer AI transaction coordinators and virtual assistants for real estate.

- Enhance Agent Training on Market Dynamics & Financing: Equip agents with in-depth knowledge of current market trends, financing options (including buy-downs, ARMs, seller financing), and strategies for negotiating in a buyer’s market.

- Implement Automated Compliance Checklists: Utilize technology to create and enforce automated checklists for every transaction phase, ensuring no crucial compliance step is missed, thereby strengthening real estate broker compliance.

- Leverage Virtual Assistants for Administrative Tasks: Offload non-deal-making tasks like data entry, scheduling, and marketing support to virtual assistants for real estate to free up agents’ time for client interactions and deal negotiation.

- Refine Lead Nurturing Processes: Implement automated workflows within your CRM or smart back office system to ensure consistent, valuable communication with leads and past clients over longer sales cycles.

Why Operational Efficiency Matters Now More Than Ever

In a market characterized by fewer transactions and potentially lower commissions, operational efficiency isn’t just about convenience; it’s about financial viability. Streamlining processes reduces overhead costs associated with manual labor, errors, and potential compliance penalties. Automated systems handle routine tasks faster and more accurately than manual methods, directly impacting the bottom line.

Beyond cost savings, efficiency improves agent productivity and retention. Agents are more likely to stay with a brokerage that provides the tools and support needed to succeed in a challenging market. By implementing solutions like AI transaction coordinators and virtual assistants for real estate, brokers empower their agents to focus on what they do best: building relationships and closing deals, even when facing the complexities of the real estate market shift for agents.

Key Points

Navigating the real estate market shift for agents requires adapting operations. Key strategies include leveraging AI transaction coordinators, virtual assistants for real estate, and real estate automation for improved efficiency, enhanced real estate broker compliance, and better client management in a high-interest-rate environment.

FAQs

How can AI Transaction Coordinators help in a slower market?

They automate routine tasks like document collection and reminders, allowing agents and TCs to focus on complex negotiations and client communication in longer deal cycles.

What administrative tasks can Virtual Assistants handle for agents?

VAs can manage scheduling, MLS entry, social media, data entry, and initial lead qualification, freeing agents to focus on core sales activities.

How important is compliance monitoring during a market shift?

Crucial. Complex deals and potential regulatory changes increase risk. Automated tools ensure checklists are followed and reduce liability for the brokerage.

Can technology improve lead nurturing in a high-rate market?

Yes. CRM and automation tools facilitate consistent, personalized follow-up over extended periods, keeping leads engaged until they are ready to act.

What is a Smart Back Office system?

An integrated platform combining CRM, transaction management, compliance, and communication to centralize data and automate workflows for better efficiency.

Resources

- ReBillion.ai Blog: Insights for Brokerage Growth

- Learn About ReBillion.ai’s AI-Powered Transaction Coordinators

- Discover AI Virtual Assistants for Real Estate Brokerages

- Visit ReBillion.ai for Smart Back Office Solutions

Conclusion

The real estate market shift for agents driven by high interest rates is challenging, but also an opportunity for brokerages to refine their operations and empower their agents. By embracing technology like AI transaction coordinators, virtual assistants for real estate, and comprehensive automation, brokers can enhance efficiency, ensure robust compliance, and position their teams for success regardless of market conditions. Adapting now is key to thriving in the future of real estate.

ReBillion.ai helps real estate brokers streamline operations with AI-powered transaction coordination, virtual assistants, and intelligent back-office automation. Whether you’re scaling your team or closing more deals, ReBillion.ai is built to simplify your brokerage’s compliance, efficiency, and growth. Visit ReBillion.ai to explore solutions or schedule a consultation.