Insurance Companies Are Required To File SAR With: A TC’s Guide to SARs

Delving into the regulatory landscape of the insurance industry reveals a critical requirement: understanding why insurance expert, dependable insurance, cool insurance, karr insurance, insurance companies are required to file sar with. Suspicious Activity Reports (SARs) are not just a banking term; they are a vital component of the broader financial system’s defense against illicit activities, and insurance companies play a significant role in this framework.

For Transaction Coordinators navigating complex real estate deals that might involve insurance components, understanding this regulatory obligation provides valuable context and highlights the importance of due diligence across related financial sectors.

Understanding SARs in the Insurance Context

At its core, a Suspicious Activity Report is a filing made by financial institutions to alert regulators and law enforcement to potential instances of financial crime, including money laundering, fraud, terrorist financing, and other illicit activities. While the concept is perhaps most commonly associated with banks, the regulatory net is cast wider.

The Bank Secrecy Act (BSA) and Insurance

The requirement for certain insurance companies to file SARs stems primarily from the Bank Secrecy Act (BSA) and its implementing regulations. While not all types of insurance are covered, those considered higher risk for money laundering, particularly products with investment features or significant cash value (like certain life insurance and annuity products), fall under BSA requirements. This means that insurers offering these products must establish Anti-Money Laundering (AML) programs, which include customer identification procedures, monitoring for suspicious activity, and filing SARs when necessary.

What Triggers an SAR Filing by an Insurer?

Identifying suspicious activity in the insurance sector can be nuanced. Regulators provide guidance, but ultimately, it requires vigilance and expertise. Common red flags that might trigger an SAR filing include:

- Unusual payment methods, such as large cash payments or payments from unrelated third parties.

- Transactions inconsistent with the customer’s known financial profile or business activities.

- Early termination of policies with significant penalties, especially if associated with unusual funding.

- Complex policy structures or transactions that lack clear economic purpose.

- Customer behavior that suggests an attempt to avoid reporting requirements or provide minimal identification.

- Activity linked to known high-risk jurisdictions or individuals on watchlists.

These are just a few examples, and compliance officers within insurance companies are trained to spot a wide range of potential indicators of illicit finance.

The Role of the Insurance Expert

Managing AML compliance and SAR filings is a complex undertaking requiring specialized knowledge. This is where the role of the insurance expert becomes critical. These professionals, often within compliance, legal, or internal audit departments, develop and implement the AML programs, conduct risk assessments, train staff, and make the crucial determination of when an activity warrants an SAR filing. Their expertise ensures that reporting obligations are met accurately and efficiently, contributing to the integrity of the financial system.

Dependable and ‘Cool’ Insurance: Upholding Integrity

How does this relate to dependable insurance or even the idea of cool insurance? A truly dependable insurance company is one that not only provides solid coverage but also operates with integrity and transparency. Robust compliance, including diligent SAR filing when required, is a hallmark of such an institution. In a modern context, transparency and ethical operations can even be considered ‘cool’ – signifying a company that is trustworthy and acts responsibly within the financial ecosystem. Whether dealing with a large national provider or a more specialized entity like Karr Insurance (used here as a hypothetical example), the expectation remains that insurance expert, dependable insurance, cool insurance, karr insurance, insurance companies are required to file sar with when the circumstances demand it.

TC Tips: Navigating Transactions with Insurance Touchpoints

While TCs don’t file SARs, being aware of these regulatory requirements is beneficial:

- Be Observant: Pay attention to unusual funding sources or payment methods in real estate transactions, particularly if they involve components that might intersect with insurance products (e.g., annuities used in financing).

- Understand the Ecosystem: Recognize that compliance obligations extend beyond real estate. Insurance companies, like other financial institutions, are gatekeepers in the fight against financial crime.

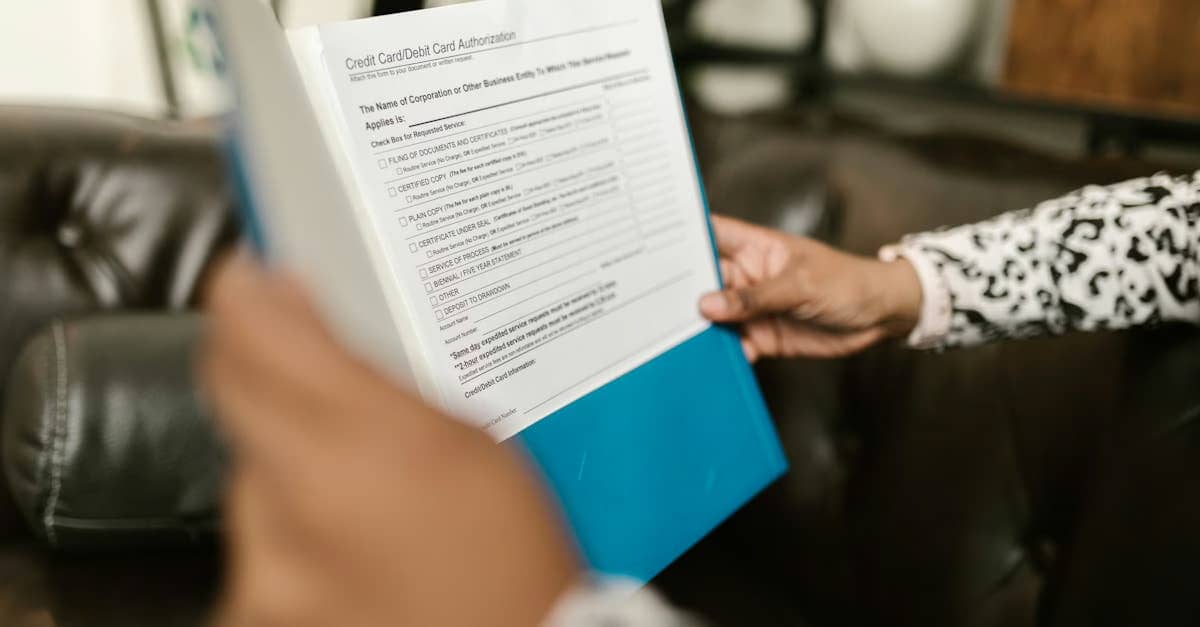

- Documentation is Key: Maintain meticulous records. Accurate paperwork helps track the flow of funds and can be crucial if questions arise about a transaction’s legitimacy. File that under ‘must read’!

- Communicate & Collaborate: If something feels genuinely suspicious, follow your brokerage’s protocols. This might involve informing your broker or consulting with professionals (like an insurance expert involved in the deal, if applicable) who have specific compliance responsibilities.

- Stay Informed: Knowledge of regulatory requirements in related fields adds depth to your expertise as a Transaction Coordinator.

Why It Matters for Transaction Coordinators

Understanding why insurance companies are required to file sar with enhances a TC’s professional acumen. It provides insight into the broader financial regulatory environment and highlights the interconnectedness of different sectors in preventing financial crime. For TCs, this knowledge isn’t about filing reports, but about recognizing potential risks, appreciating the compliance burden carried by other parties in a transaction, and reinforcing the need for thorough documentation and ethical practices in their own work. It helps TCs serve as more informed and diligent transaction managers.

Analysis & Insights

The regulatory focus on AML/CFT compliance in the financial sector, including insurance, has intensified globally. Insurance products, particularly those with investment features, have been identified as potential avenues for money laundering due to their complexity and the potential for large sums of money to change hands. Consequently, regulators like the Financial Crimes Enforcement Network (FinCEN) in the U.S. have provided specific guidance for the insurance industry. The volume of SAR filings across all industries provides critical intelligence to law enforcement agencies investigating financial crimes. This underscores the vital role that seemingly administrative tasks like SAR filing play in national and international security.

FAQs

- Q: What exactly is an SAR?

- A: An SAR, or Suspicious Activity Report, is a document filed by financial institutions (including certain insurance companies) with financial regulators to report transactions or activities suspected to involve money laundering, fraud, or other financial crimes.

- Q: Are all insurance companies required to file SARs?

- A: No, the requirement primarily applies to insurers offering products deemed susceptible to money laundering, such as certain life insurance policies, annuities, and other investment-related insurance products, under the scope of the Bank Secrecy Act.

- Q: Can a Transaction Coordinator file an SAR?

- A: Typically, no. SAR filing is a responsibility of regulated financial institutions. However, TCs should report any suspicious observations to their broker or supervising entity, who can then determine the appropriate course of action.

- Q: How does knowing about insurance SARs help a TC?

- A: It broadens a TC’s understanding of financial compliance, helps identify potential red flags in complex transactions involving insurance, and reinforces the importance of regulatory diligence in the financial ecosystem connected to real estate.

- Q: Where can I find official information about SARs?

- A: The Financial Crimes Enforcement Network (FinCEN) website is the primary official source for information on SAR requirements in the U.S.

Resources

To deepen your understanding of the financial ecosystem surrounding real estate and how technology can assist in managing complex processes, consider the following resources:

- Learn more about automating your workflow: Rebillion TC Automation Tools

- Explore insights on real estate: Rebillion’s Real Estate Blog

- Discover AI solutions for business: Rebillion.ai

Conclusion

While the intricacies of insurance compliance, specifically why insurance expert, dependable insurance, cool insurance, karr insurance, insurance companies are required to file sar with, might seem distant from daily TC tasks, they are part of the larger picture of maintaining integrity in financial transactions. Staying informed on these crucial compliance matters is part of being a truly dependable transaction expert in today’s market. It equips TCs with a broader perspective and reinforces the importance of diligence in every step of the transaction process.

*Image credits pexels.com