Unlock Brokerage Efficiency with Expert Transaction Coordination

Transaction coordination is no longer just an administrative task; it’s an up-and-coming profession critical to the success and compliance of modern real estate brokerages. For brokers, navigating the complex web of contracts, disclosures, deadlines, and regulatory requirements while simultaneously managing agents and fostering growth presents a significant operational and compliance pain point. In this demanding environment, a dedicated focus on transaction coordination offers not just relief, but a strategic advantage. It's about ensuring every "I" is dotted and every "T" is crossed, protecting both the brokerage and its agents, and ultimately, enhancing the client experience.

The Evolving Role of the Transaction Coordinator

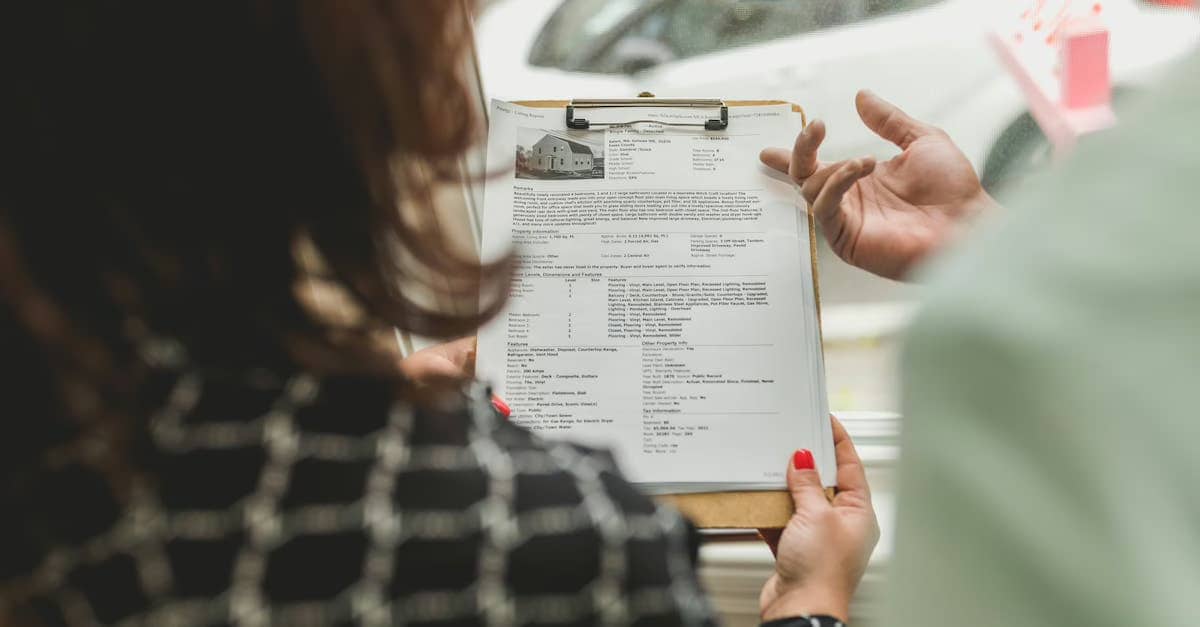

Once seen primarily as contract-to-close paperwork handlers, today’s transaction coordinators (TCs) are highly skilled professionals. They are the operational backbone, ensuring deals move smoothly and compliantly from executed contract to closing. This involves meticulous file management, deadline tracking, communication with all parties (agents, clients, lenders, escrow/title, other agents), and proactive problem-solving. As real estate regulations become increasingly stringent and transaction volume potentially increases, the expertise of a proficient TC becomes indispensable.

Why Brokers Need Professional Transaction Coordination Now

Broker-owners and managers face immense pressure. They are responsible for their agents' activities, compliance with state and federal laws, risk management, and maintaining profitability. Delegating the intricate details of transaction management to dedicated professionals frees up brokers and agents to focus on lead generation, client relationships, and negotiation – the revenue-generating activities. More importantly, skilled transaction coordination significantly mitigates the risk of compliance errors, missed deadlines, and incomplete documentation that can lead to costly fines, lawsuits, or damaged reputations.

Compliance and Risk Mitigation

Real estate transactions involve vast amounts of documentation and strict timelines. Failure to adhere to these can have serious consequences. A professional TC is expertly trained to manage disclosures, addenda, reports, and ensure all required signatures and dates are in place. They act as a critical checkpoint, verifying that files are complete and accurate before closing and for post-closing audits. This dedicated focus on compliance is paramount in today's litigious market. For instance, ensuring proper handling of earnest money, delivery of HOA documents, or timely delivery of inspection reports are just a few areas where TC expertise prevents potential legal pitfalls. They stay updated on changing regulations, providing a layer of protection that agents, often focused on sales, may overlook.

Enhancing Agent Productivity and Satisfaction

Agents spend a disproportionate amount of time on administrative tasks related to managing transactions. Studies show agents could spend up to 70% of their time on non-sales activities. Offloading the detailed, time-consuming paperwork and coordination allows agents to allocate their time more effectively. This leads to increased productivity, higher sales volume, and greater job satisfaction. When agents know their transactions are being handled efficiently and compliantly by a professional, they have greater peace of mind and more energy to devote to finding new clients and negotiating deals. Offering professional transaction coordination support can also be a significant recruiting and retention tool for brokerages.

Streamlining Operations and Improving Efficiency

A standardized, efficient transaction coordination process brings order to the potential chaos of multiple simultaneous deals. TCs implement and manage workflows, utilize checklists, and ensure consistent procedures are followed for every transaction. This operational efficiency reduces delays, minimizes errors, and creates a smoother experience for everyone involved, including clients. A streamlined process also makes it easier for brokerages to scale their operations without a proportional increase in administrative overhead.

Integrating Technology and AI into Transaction Coordination

The profession of transaction coordination is being transformed by technology. Modern TCs leverage software platforms to manage documents, track deadlines, and communicate. The advent of AI and machine learning is taking this to the next level. AI-powered tools can automate routine data entry, flag missing documents, predict potential delays based on historical data, and even draft standard communication emails. This allows TCs to handle a higher volume of transactions with greater accuracy, focusing their human expertise on complex issues, client communication, and relationship management.

AI Transaction Coordinators and Virtual Assistants

Platforms like ReBillion.ai are at the forefront of this technological shift, offering AI-powered transaction coordinators and virtual assistants for real estate. These tools can handle many of the repetitive, administrative tasks traditionally performed by a human TC, such as initiating files, sending out standard requests, organizing documents, and setting reminders. This doesn’t replace the human TC but augments their capabilities, allowing them to oversee more transactions or focus on higher-value tasks. For brokerages that may not have the volume or budget for a full-time in-house TC, leveraging AI virtual assistants provides a flexible and cost-effective solution to gain the benefits of professional transaction management.

Workflow Automation and Smart Back Office

Beyond individual tasks, workflow automation tools can connect different parts of the transaction process. From initial contract input to closing checklist completion, automation ensures steps are followed in order, notifications are sent automatically, and required documents are requested at the right time. ReBillion.ai’s smart back office features integrate transaction management with CRM and compliance monitoring, providing a holistic view of the brokerage's operations. This level of integration reduces manual data entry, prevents information silos, and provides brokers with real-time insights into their business performance and compliance status.

Agent-Broker Compliance Monitoring

Compliance monitoring is a critical function that can be significantly enhanced by technology. AI tools can review documents for compliance requirements, flag missing elements, or highlight potential issues based on predefined rules and checklists. This proactive approach ensures that files are compliant throughout the transaction lifecycle, not just at the end. ReBillion.ai’s compliance monitoring features help brokers ensure that agents are following brokerage policies and regulatory requirements, significantly reducing risk and liability.

Actionable Tips for Implementing or Enhancing Transaction Coordination

For brokers and administrators looking to leverage the power of professional transaction coordination, consider these actionable tips:

- Define Clear Processes: Standardize your transaction workflow. Map out every step from contract to close, identifying required documents and deadlines.

- Invest in Technology: Adopt a dedicated transaction management software or a comprehensive platform like ReBillion.ai that integrates transaction coordination, CRM, and compliance.

- Train Agents on TC Utilization: Educate your agents on the value of using a TC and the process for handing off files effectively. Ensure they understand what the TC handles versus their responsibilities.

- Establish Communication Protocols: Define how TCs will communicate with agents, clients, and third parties to ensure everyone is informed and expectations are managed.

- Regularly Review Processes and Performance: Continuously evaluate your transaction coordination workflow for bottlenecks and areas of improvement. Use data from your management platform to track efficiency and identify training needs.

Why Professional Transaction Coordination Matters to Your Brokerage

Implementing professional transaction coordination is not merely an expense; it is a strategic investment with a clear return. Operationally, it creates efficiency, reduces stress on agents and staff, and standardizes processes, making the brokerage easier to manage and scale. Financially, it protects the brokerage from potentially ruinous compliance fines and lawsuits, ensures smoother closings leading to faster commission payouts, and allows agents to close more deals, directly impacting the brokerage's bottom line through increased GCI.

Furthermore, a reputation for smooth, compliant transactions enhances the brokerage's standing in the market, attracting both clients and top-performing agents. In a competitive landscape, the ability to consistently deliver a seamless closing experience sets a brokerage apart. Professional TCs are integral to building and maintaining this reputation for excellence and reliability.

Key Points

Professional transaction coordination is vital for real estate brokerages. It ensures compliance, reduces risk, boosts agent productivity, streamlines operations, and enhances profitability. Leveraging technology like AI transaction coordinators and automation tools amplifies these benefits, creating a more efficient and secure back office.

FAQs: People Also Ask

What does a real estate transaction coordinator do?

A transaction coordinator manages the administrative process of a real estate deal from contract to closing, ensuring all paperwork, deadlines, and communications are handled compliantly and efficiently.

How does transaction coordination benefit real estate agents?

TCs free up agents’ time by handling administrative tasks, allowing agents to focus on lead generation, sales, and client relationships, leading to increased productivity and higher income.

Is transaction coordination mandatory?

While not always legally mandated, professional transaction coordination is highly recommended for brokerages to ensure compliance, reduce risk, and improve operational efficiency and agent support.

Can AI replace human transaction coordinators?

AI tools and virtual assistants enhance transaction coordination by automating tasks, but human TCs remain essential for complex problem-solving, client communication, and navigating unique transaction challenges.

How can a brokerage implement transaction coordination?

Brokerages can hire in-house TCs, outsource to a TC company, or leverage technology platforms offering AI-powered transaction coordination and virtual assistants to streamline their process.

Resources

- ReBillion.ai Home

- AI Transaction Coordinators for Real Estate

- Virtual Assistants for Real Estate Brokerages

- ReBillion.ai Blog

- Contact ReBillion.ai

Conclusion

The landscape of real estate is constantly changing, with increasing demands for efficiency and strict adherence to compliance. Professional transaction coordination is no longer a luxury but a necessity for brokerages aiming for sustainable growth and reduced risk. By implementing robust transaction management processes, ideally supported by innovative technology, brokerages can empower their agents, protect their business, and provide an exceptional experience for every client.

ReBillion.ai helps real estate brokers streamline operations with AI-powered transaction coordination, virtual assistants, and intelligent back-office automation. Whether you’re scaling your team or closing more deals, ReBillion.ai is built to simplify your brokerage’s compliance, efficiency, and growth. Visit ReBillion.ai to explore solutions or schedule a consultation.