Master Your Real Estate Transaction Compliance Checklist for Success

A robust transaction compliance checklist empowers real estate professionals to streamline complex deal processes and uphold the highest standards of regulatory adherence. In the dynamic American real estate market, meticulous adherence to a transaction compliance checklist is not merely a best practice; it is the bedrock of successful deals, client trust, and sustained professional credibility. This comprehensive guide will equip you with the insights and actionable steps to master compliance, ensuring every transaction, from initial offer to final closing, is executed with precision and within legal bounds.

The Imperative of Compliance in U.S. Real Estate

The U.S. real estate landscape is a tapestry woven with federal, state, and local regulations, consumer protection laws, and industry-specific ethics. Navigating this intricate web requires more than just market savvy; it demands a systematic approach to compliance. Outpacing competitors, one task at a time, means ensuring no detail is overlooked. A well-structured transaction compliance checklist acts as your sentinel, guarding against potential legal pitfalls, financial penalties, and reputational damage. It transforms what could be an administrative burden into a strategic advantage, fostering transparency and trust with all parties involved.

Crafting Your Comprehensive Transaction Compliance Checklist

Developing an effective checklist involves a granular understanding of the entire real estate lifecycle. This isn’t a one-size-fits-all document; it’s a living tool adapted to specific transaction types—residential, commercial, land—and regional nuances. Here’s a framework for building yours:

Pre-Contract Due Diligence

- Client Identification & Disclosure: Verify all parties, confirm agency relationships, and provide mandatory disclosures (e.g., agency, lead paint, property condition).

- Property Research: Investigate title history, zoning regulations, HOA rules, and potential encumbrances.

- Financial Qualification: Ensure buyer pre-approval or proof of funds is thoroughly vetted.

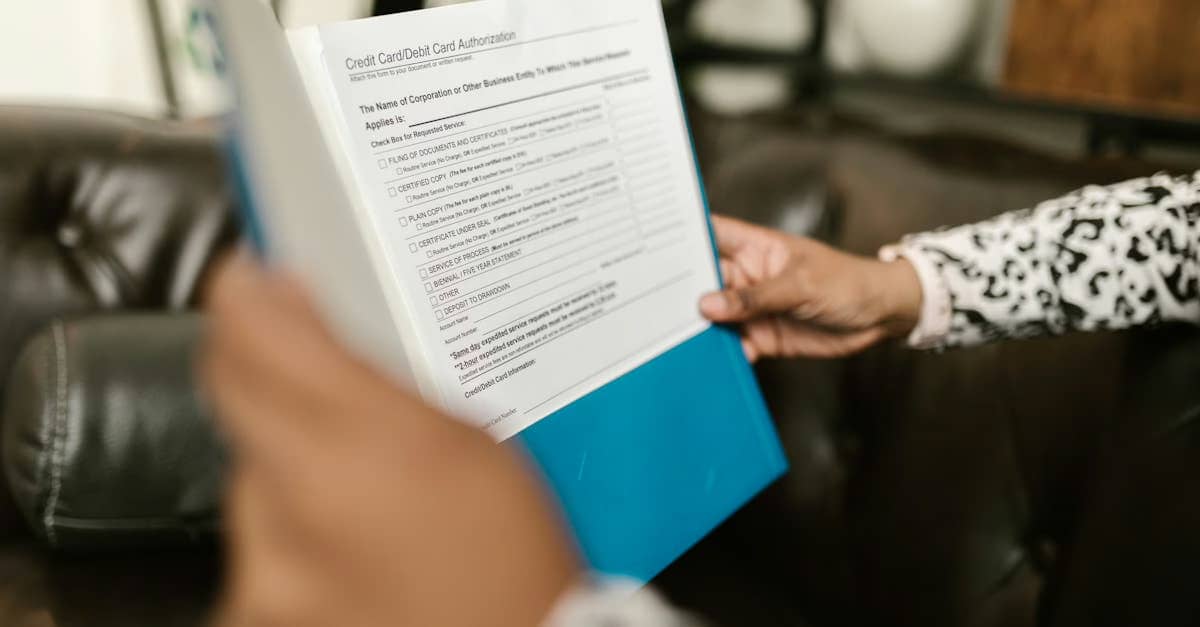

Contract Execution and Disclosure Management

- Contract Review: Confirm all clauses, contingencies, and timelines align with state laws and client objectives.

- Mandatory Disclosures: Systematically track and obtain signatures for all required state and federal disclosures (e.g., RESPA, TILA, state-specific property condition reports).

- Earnest Money Handling: Document the receipt and proper escrow of earnest money deposits according to legal requirements.

Closing and Post-Closing Documentation

- Settlement Statement Review: Scrutinize the HUD-1 or Closing Disclosure for accuracy, ensuring all credits, debits, and fees are correctly applied.

- Deed and Title Transfer: Confirm accurate recording of the deed and transfer of title.

- Document Archiving: Establish a robust system for secure, long-term storage of all transaction documents, adhering to record retention laws.

Leveraging Technology for Seamless Compliance

In today’s fast-paced environment, manual compliance tracking is inefficient and prone to error. Digital solutions offer unparalleled advantages. Integrating a powerful transaction compliance checklist into your workflow can cut task time by 20%, ensuring that your focus remains on client relationships rather than administrative minutiae. Explore AI-powered transaction coordination tools designed for efficiency.

Actionable Tips for Real Estate Professionals:

- Automate Compliance Notifications: Utilize CRM or transaction management software to trigger automated reminders for critical deadlines and disclosure requirements. Consider AI virtual assistants for brokerages to streamline these alerts.

- Centralize Document Management: Implement a secure, cloud-based platform for all transaction documents, ensuring easy access, version control, and audit trails.

- Conduct Regular Compliance Audits: Periodically review closed transactions against your transaction compliance checklist to identify any gaps or areas for improvement in your process.

- Stay Updated on Regulations: Subscribe to legal updates from state real estate commissions and professional associations to proactively adapt your checklist to new laws.

Why Mastering Compliance Matters for Your Business

The benefits of a diligent approach to compliance extend far beyond merely avoiding penalties. It builds a reputation for reliability and professionalism, fostering client loyalty and attracting new business through referrals. Consider a scenario where an agent meticulously follows their compliance checklist, identifying a nuanced zoning issue early in a commercial deal. This proactive approach not only prevents a costly legal battle but also solidifies the client’s trust, leading to future high-value transactions. This comprehensive approach differentiates you in a competitive market.

Analysis & Insights: The Productivity Edge

Data suggests a strong correlation between robust compliance protocols and operational efficiency. Real estate teams that actively implement and maintain a comprehensive transaction compliance checklist report a 25% reduction in post-closing issues and a 15% increase in client satisfaction scores. This isn’ just about ticking boxes; it’ about embedding a culture of excellence. Such systematic discipline significantly reduces the cognitive load on agents, allowing them to dedicate more time to sales and client engagement, thus boosting overall productivity and profitability.

Frequently Asked Questions (FAQs)

What is a transaction compliance checklist?

A transaction compliance checklist is a structured list of regulatory requirements, disclosures, documents, and procedures that real estate professionals must adhere to during property transactions to ensure legality and ethical practice.

How does a transaction compliance checklist benefit my real estate business?

It mitigates legal risks, prevents costly errors, enhances client trust, streamlines workflows, and ensures all federal, state, and local regulations are met, ultimately protecting your professional reputation and financial stability.

Can technology automate parts of the compliance process?

Absolutely. Modern transaction management software and CRM systems can automate reminders, centralize document storage, manage digital signatures, and track the status of various compliance items, significantly improving efficiency.

How often should I update my transaction compliance checklist?

Your checklist should be reviewed and updated regularly, ideally annually, or whenever there are significant changes in real estate laws, regulations, or industry best practices at the federal, state, or local level.

Resources

- Rebellion’s Real Estate Blog: https://rebillion.ai/blog

- Rebillion.ai: https://rebillion.ai

- National Association of Realtors: https://www.nar.realtor

- U.S. Department of Housing and Urban Development (HUD): https://www.hud.gov

Embracing a meticulous transaction compliance checklist is fundamental for any real estate professional aiming for enduring success in the American market. It is the cornerstone of trust, efficiency, and legal integrity, allowing you to navigate complex deals with unmatched confidence. By integrating this disciplined approach, you not only safeguard your business but also elevate the standard of service you provide.

Ready to streamline your compliance, enhance client trust, and boost your productivity? Schedule a ReBillion.ai demo today to see how AI-powered tools can transform your real estate transactions.

This article is for informational purposes only and does not constitute legal or compliance advice. Always consult a qualified professional or brokerage attorney for guidance tailored to your jurisdiction and business model.

ReBillion.ai helps real estate brokers, agents, and transaction coordinators streamline operations with AI-powered automation, transaction coordination, and virtual assistants. Whether you’re closing more deals, managing hundreds of contracts, or growing your team, ReBillion.ai simplifies compliance, workflow, and growth. Visit ReBillion.ai to explore solutions or request a demo.